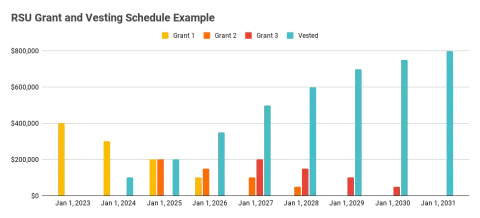

Have you ever wondered how taxes work with RSUs (Restricted Stock Units)? RSUs are basically shares your company grants you over time as part of your compensation package, and when they vest, they're taxed as ordinary income by the IRS. RSUs are complicated because of their grant and vesting schedules and their taxes can be even more tricker.

Investing in stocks of businesses you understand is crucial for making informed decisions and potentially earning higher returns in the stock market. This strategy allows for a better understanding of a company's operations, financial health, and growth prospects, leading to increased confidence in investment decisions and the ability to withstand market fluctuations. Over time, sticking with familiar companies can compound investments and build sustainable wealth, as exemplified by Warren Buffett's long-term success in the market.

Investing in wonderful businesses is a key strategy for building profitable and sustainable investments, applicable across various scales from stocks to real estate. Key factors to consider include the business's competitive advantage, financial health, management team, industry trends, and fair valuation. Thorough research and analysis are essential to ensure investments offer competitive returns and long-term wealth-building potential.