If you get RSUs from your company and wondering how taxes are calculated and paid on them, you’ve come to the right place. In this article, I will talk all about RSUs and a pro tip on paying taxes for them.

What are RSUs?

RSUs stands for Restricted Stock Units, a form of equity compensation that some companies use to incentivize their best employees. With RSUs, a company grants an employee a certain number of shares of the company stock that get added to the employee’s overall compensation, which vests gradually over a period of time. The total value of the RSUs granted is typically based on the market price of the company’s stock on the day of granting.

When the RSUs vests, the company releases the previously granted shares to the employee, after deducting taxes or withholding. The employee now can choose to either hold onto the vested shares or sell them for cash. The value of the shares at vesting is typically based on the market price of the company’s stock on the day of vesting.

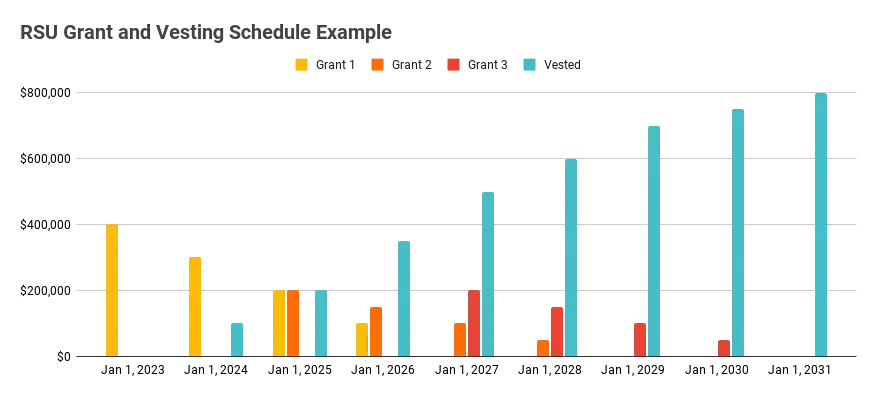

Some companies provide multiple grants to employees to incentivize them to stay longer and this is when things can get really complex. You can see in the example below how complex it can get with only three different grants and their vesting schedules. Grant 1 vest $100K/year, Grant 2 vest $50K/year and Grant 3 vests $50k/year.

Taxes on RSUs

In the eye of the IRS, RSUs are considered ordinary income, i.e. upon vesting the total amount vested is considered employer compensation which is taxed at the rate based on your withholding. If the RSUs are sold after vesting, any gains or losses from the sale will be subject to short or long-term capital gains taxes depending on the period of time they were held for after vesting.

Since RSUs are considered employer compensation, upon vesting the brokerage will automatically collect taxes using one of the several methods and transfer it to your company’s payroll. Here, are the three most common methods available,

- Sell To Cover: The brokerage will sell a portion of the vested shares to cover taxes.

- Cash Transfer: You will be asked to deposit cash to cover taxes.

- Same-day Sale: The brokerage will sell all the vested shares, a portion of it will be used to cover taxes and the rest will be provided to you.

Pro Tip, as promised!

I promised in the earlier section to provide a pro tip on paying taxes for RSUs, here it is. If your company offers you ESPP as well, which in summary allows you to purchase your company’s stock at a discount on the lowest price in the past few months, you are better off choosing “Sell to Cover” instead of “Cash Transfer” for RSUs at the vest and divert the cash you saved to purchase ESPP.

In practice, this will leave you with more stock units of the same ticker, which in turn will lower your average cost for the total stock holding.

What if I do both, Cash Transfer for RSUs and ESPP?

The only constraint is cash flow, if you have the cash to pay for RSU taxes at vesting and also set aside $$ for ESPP, it’s even better. However, I recognize it may not apply to masses with other lifestyle expenses which may create cash flow constraints.

Final Thoughts

RSUs are part of your compensation and are going to be taxed as such. When paying for RSU taxes at vesting, you have several options. Try to learn about them from your brokerage and/or consult a tax professional as appropriate. If do “Sell to Cover” for RSUs at vesting and participate in ESPP, you allow the same $$ to run farther.

Comments